Summary

This blog breaks down the pros and cons of investing in vacation rentals. It covers the potential for higher income and personal use, as well as challenges like seasonal demand, higher upkeep, and local regulations.

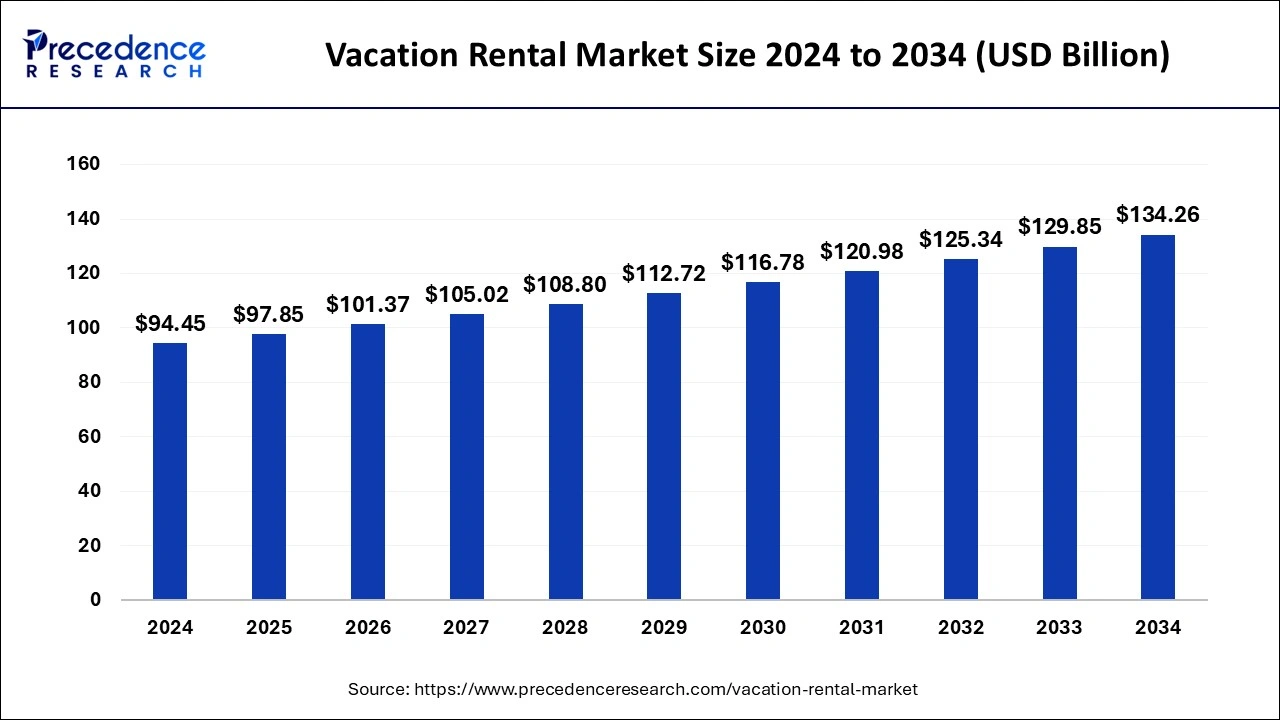

Vacation rentals have surged in popularity in the past two decades, driven by platforms like Airbnb and Vrbo, changing traveler preferences, and the rise of remote work. According to Precedence Research, the vacation rental market is expected to continue to grow over the next decade. At Community Capital, we help investors evaluate the right strategies for their goals. Here’s a closer look at the advantages and disadvantages of investing in vacation rental properties.

Pros of Vacation Rentals

1. Higher Income Potential

Compared to long-term rentals, vacation properties can generate significantly more income especially in high-demand areas. With dynamic pricing, nightly rates can spike during peak seasons, leading to strong returns when managed well.

2. Personal Use

One of the unique benefits of owning a vacation rental is that you can enjoy it yourself. Whether it’s a beachfront condo or a cozy cabin, investors can block off personal time and enjoy their asset while it appreciates.

3. Diversification

Vacation rentals offer a hedge against traditional rental markets. Their performance is tied more to tourism and travel trends, giving investors an alternative stream of income that doesn’t necessarily correlate with local job markets.

4. Tax Deductions

Owners may qualify for deductions on expenses like property management, maintenance, utilities, and depreciation. Under certain conditions, even travel expenses to your property can be deductible, though it’s essential to work with a tax advisor.

Cons of Vacation Rentals

1. Seasonality & Income Volatility

Unlike long-term tenants, short-term rental income isn’t guaranteed year-round. Off-season lulls or unexpected downturns in tourism can leave properties sitting empty, impacting cash flow.

2. Higher Management Costs

Vacation rentals require frequent cleaning, guest communication, and maintenance. Unless you’re local and hands-on, you’ll likely need a property manager, often charging 20-30% of booking revenue.

3. Regulatory Risks

Many cities and counties have implemented stricter vacation rental regulations, including permit requirements, stay limits, or outright bans. Compliance is crucial, and restrictions can change with little notice.

4. Wear and Tear

With a high turnover of guests, vacation rentals often experience more wear and tear than traditional rentals. This means more frequent replacements, upgrades, and general upkeep.

Is a Vacation Rental Right for You?

If you’re looking for high earning potential and don’t mind a more active management style (or hiring help), vacation rentals can be a powerful addition to your portfolio. But they aren’t passive investments. and they come with unique risks.

Need help evaluating your next move? Community Capital offers lending solutions tailored to vacation rental properties, including fix-and-furnish loans, bridge loans, and refinancing options. Reach out today to explore financing that fits your investment strategy.