Short-Term Property Financing Surges At Nonbank Lenders

According to CoStar News, early 2025 lending has already surpassed last year’s entire first-quarter total. This early showing for the commercial real estate market is seen by some property professionals as a positive sign that capital could pour into commercial… Continue Reading Short-Term Property Financing Surges At Nonbank Lenders

Hard Money Loans Offer Fast Funding and Flexible Terms to Maximize Profits for House Flippers

Hard money loans – or private money loans – are a potent tool in the arsenal of real estate investors, especially house flippers here in Florida. They offer unparalleled speed, flexibility, and support, making these alternative lending options ideal for… Continue Reading Hard Money Loans Offer Fast Funding and Flexible Terms to Maximize Profits for House Flippers

South Florida Office Market Sees Steady Demand

With demand remaining relatively steady in South Florida and competition for top office buildings remains strong, developers are adding amenities like wellness rooms and restaurants in buildings across Miami-Dade, Broward and Palm Beach Counties. Read the full New York Times… Continue Reading South Florida Office Market Sees Steady Demand

Bridge lending to pick up steam in 2024

As borrowers explore shorter-term debt while rates are high and there is an expectation they will start coming down, and people turn to bridge lending as notes come due and more value-add opportunities hit the market – watch for bridge… Continue Reading Bridge lending to pick up steam in 2024

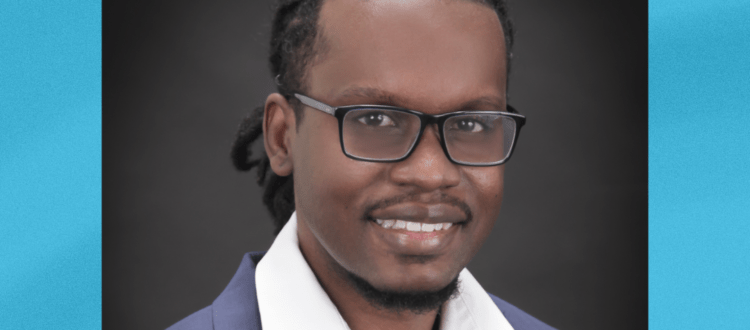

NAIOP of South Florida Welcomes New Member – Atiba Harris

Congratulations to Community Capital’s Senior Business Development Manager & Analyst Atiba Harris for joining the NAIOP’s South Florida chapter – the largest in the Sunshine State. The National Association for Industrial and Office Parks (NAIOP) supports commercial real estate professionals with advocacy,… Continue Reading NAIOP of South Florida Welcomes New Member – Atiba Harris

As Conventional Lenders Slow, Blackstone Considers Partnerships

As conventional lenders slow down their funding, investment giant Blackstone Inc. is considering partnerships with regional banks – which have had their own issues lately as depositors have sought other places to put their money. What does this mean for… Continue Reading As Conventional Lenders Slow, Blackstone Considers Partnerships